Cast Is No Panacea People often ask what "so and so" actor is worth to a film, but my answer, I think, is almost never satisfactory, because an actor can seldom "open" a picture. They can be right for the part, and they can enhance the quality of a film just like all

Continue ReadingWhat in Holy Hell Are Indie Films Facing in 2021?

First, I'm Not A Seer I do not style myself a future predictor, so, I want to say that I do not KNOW exactly what things will be like in 2021; but the following are not just random thoughts, they are based on detailed study. Having spent a good bit of my life

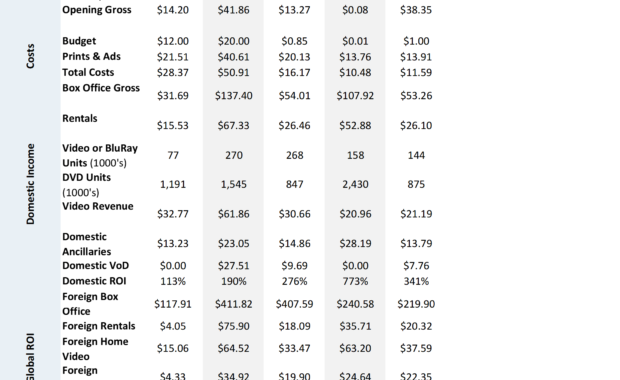

Continue ReadingComparable Pictures (ROIs) List

This Table Lists Almost All of the Film Titles Currently in Our Database But don't let that stop you from asking for a film, as we are constantly adding titles. You can download this pdf and peruse, search, take you time with checking for the films you desire, or get

Continue ReadingBooksmart Release – Is This the New Way We Distribute Indie Films?

Having read quite a few mentions of the Booksmart film not performing up to snuff, or to expectations, and even discussion as to whether this augurs weakness for women-themed films, or women-helmed films, I wanted to look. A Wide Release Then I started to look at

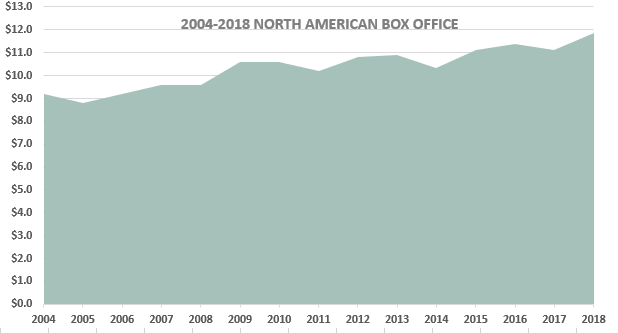

Continue ReadingRetreat from 2017 Panic!

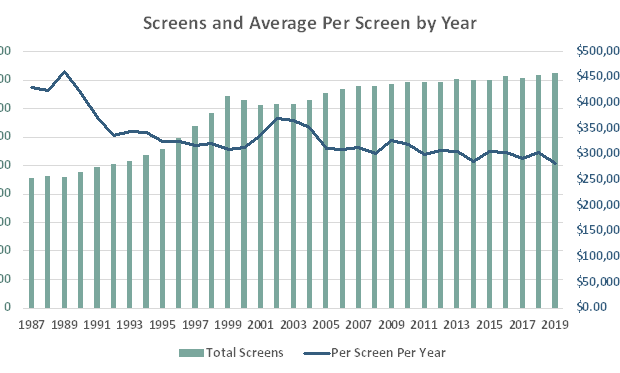

Box Office Returns to Form in 2018 In late 2017, the biggest story was whether box office was falling off of a cliff or not, after the somewhat disastrous Summer and weak Fall season we discussed in last year's Box Office Panic! series. We've Seen This Before We

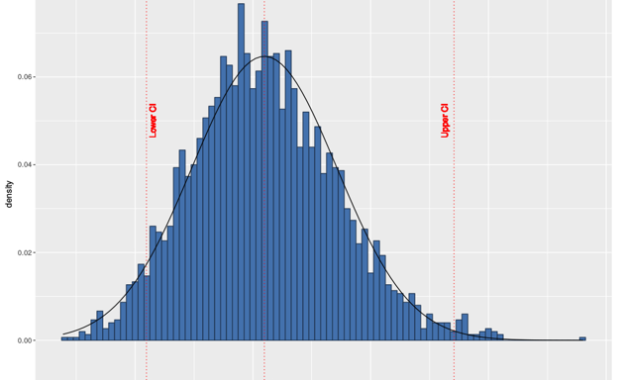

Continue ReadingAnnouncing A New Product, Statistical Confidence Modeling in Film Projections

Bootstrapping Our Way to Confidence and Probability Over our 25 years of financial modeling for films and slates and funds, we have developed sophisticated methods for modeling a film or films in distribution. Because of our hard-won proprietary data and years of deep

Continue ReadingComparable Pictures: How to Choose ‘Em and Use ‘Em

I get a lot of clients who find it difficult to choose comparable films right off the bat. I wrote this article to help them, and help others, even if they do not become clients. Bona Fortuna to all! How I Go About Choosing Comparable Pictures In a given year I might

Continue ReadingFilmProfit Glossary of Film Terms

This is a Glossary of Key Terms Above The Line Budgets for films usually begin with a section that covers creative talent such as: actors, directors, producers, and writers. This section is followed by the rest of the budget, or Below the line. This term also refers to the

Continue Reading