First, I'm Not A Seer I do not style myself a future predictor, so, I want to say that I do not KNOW exactly what things will be like in 2021; but the following are not just random thoughts, they are based on detailed study. Having spent a good bit of my life

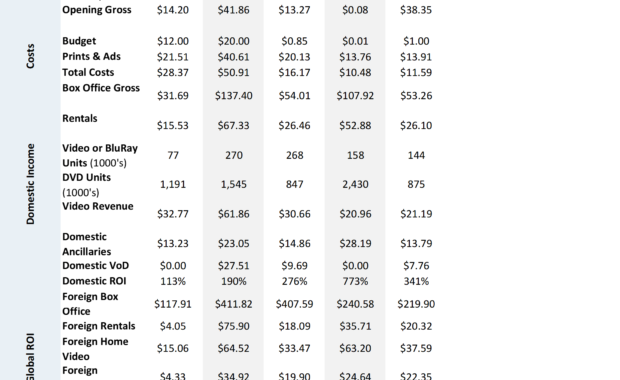

Continue ReadingComparable Pictures (ROIs) List

This Table Lists Almost All of the Film Titles Currently in Our Database But don't let that stop you from asking for a film, as we are constantly adding titles. You can download this pdf and peruse, search, take you time with checking for the films you desire, or get

Continue ReadingComparable Pictures: How to Choose ‘Em and Use ‘Em

I get a lot of clients who find it difficult to choose comparable films right off the bat. I wrote this article to help them, and help others, even if they do not become clients. Bona Fortuna to all! How I Go About Choosing Comparable Pictures In a given year I might

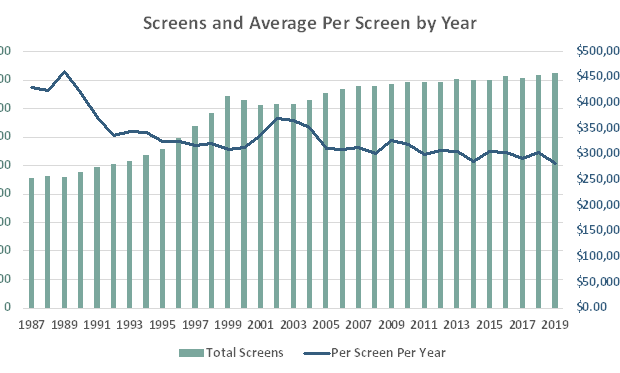

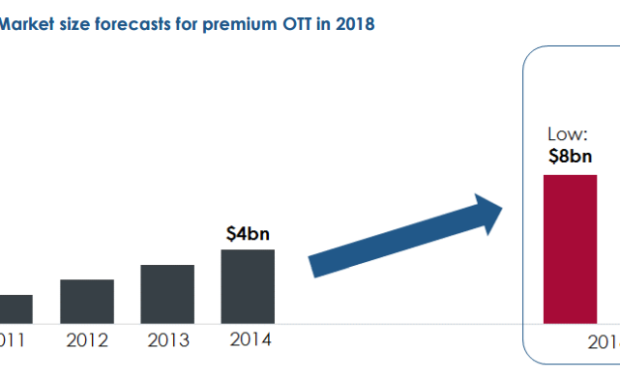

Continue ReadingThe Proliferation of Digital (VOD/SVOD/etc.) and the Further Fracturing of Markets

As seen from the view in Brazil It has been true over the last forty years that as a new movie-viewing platform arrives, chances for consumers to hone their tastes, and to fine-tune their choices has expanded film viewing and expanded film income. At the same time,

Continue ReadingWhy is Video on Demand so Attractive?

And Why Are So Many People Mystified About Video on Demand and Its Contribution to a Film’s Value? It’s attractive because delivering a film is expensive, and the core purpose of filmmaking is sharing what you made, the story you have told. More ways to share it are

Continue Reading