In this era of ‘Big Data’ buzzwords flying everywhere, “We at FilmProfit prefer to focus on the accuracy and the appropriateness of data, not its height or its girth.” FilmProfit Uses Latest Data Science Techniques to Guide Financial Modeling Deep knowledge of the

Continue ReadingAnnouncing A New Product, Statistical Confidence Modeling in Film Projections

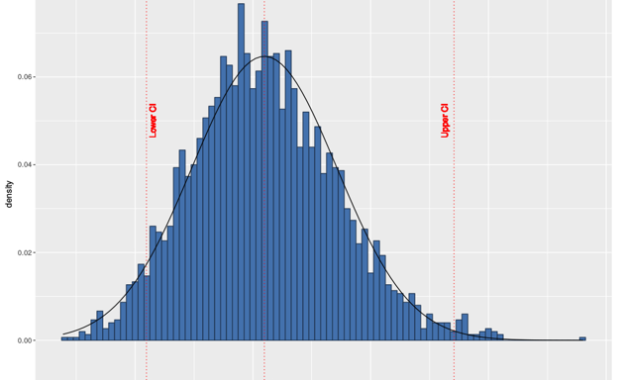

Bootstrapping Our Way to Confidence and Probability Over our 25 years of financial modeling for films and slates and funds, we have developed sophisticated methods for modeling a film or films in distribution. Because of our hard-won proprietary data and years of deep

Continue ReadingComparable Pictures: How to Choose ‘Em and Use ‘Em

I have helped producers choose and use literally thousands of titles for comparison to the films they seek to finance and make. When I am preparing projections and financials packages, whether for a single film or a slate of films, the first crucial task for me is to

Continue ReadingHow Do You Kick-Start Your Business Plan?

What The Heck Is The Thru-Line? And Why Is Every Film A Marketing Challenge and An Opportunity? ***I am updating this article, particularly after a discussion with a client that tweaked my thinking on using the word “problem.” Every time I used it, I found myself

Continue ReadingWhat is a Film Business Plan?

This is a foray into the key elements of a business plan, in which the philosophy, and the nitty gritty of proper business planning will be discussed. Feel free to respond. Comments that can be helpful to others may end up in future issues. My intention is to walk through

Continue Reading