Earlier this year, Nancy Fulton, of Nancy Fulton Meetups interviewed Jeffrey and one of the people he works with often, about how he helps indie film producers prepare themselves and their project for successful finance.

Continue ReadingJeffrey Hardy Interviewed by Nancy Fulton

Earlier this year, Nancy Fulton, of Nancy Fulton Meetups interviewed Jeffrey about how he helps indie film producers prepare themselves and their project for successful finance.

Continue ReadingWhat in Holy Hell Are Indie Films Facing in 2021?

First, I'm Not A Seer I do not style myself a future predictor, so, I want to say that I do not KNOW exactly what things will be like in 2021; but the following are not just random thoughts, they are based on detailed study. Having spent a good bit of my life

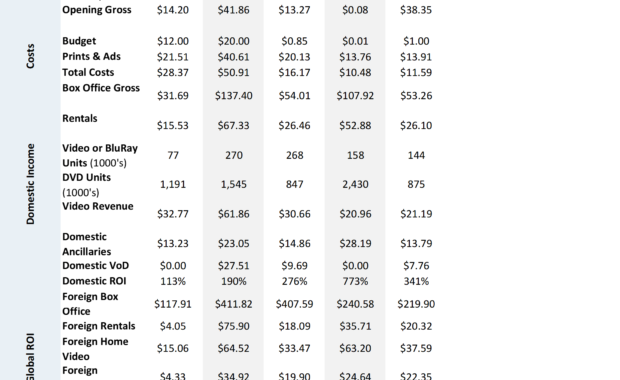

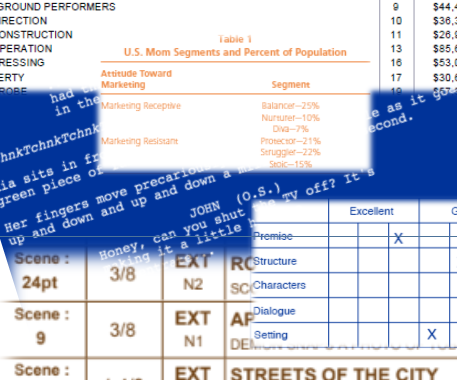

Continue ReadingComparable Pictures (ROIs) List

This Table Lists Almost All of the Film Titles Currently in Our Database But don't let that stop you from asking for a film, as we are constantly adding titles. You can download this pdf and peruse, search, take you time with checking for the films you desire, or get

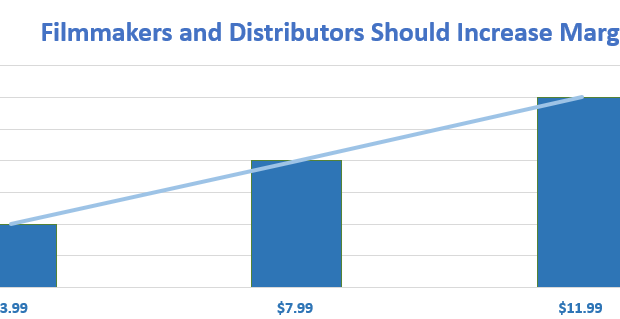

Continue ReadingIndies Lose Freedom (and money) Under Studio-Set Deals

What I Have Never Understood Why does the independent portion of the business let the studios and big theater chains set all the rules, set ticket prices, set these DVD prices, set release windows, in fact, set many of the conditions under which the indies and the indie

Continue ReadingBooksmart Release – Is This the New Way We Distribute Indie Films?

Having read quite a few mentions of the Booksmart film not performing up to snuff, or to expectations, and even discussion as to whether this augurs weakness for women-themed films, or women-helmed films, I wanted to look. A Wide Release Then I started to look at

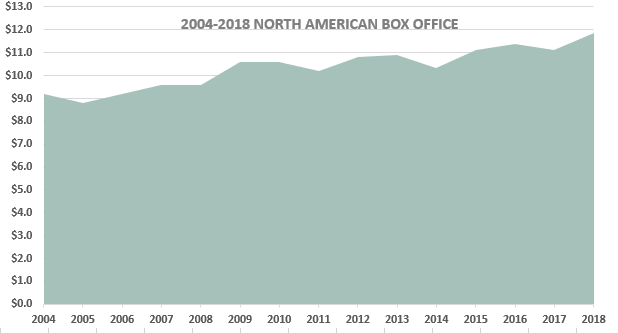

Continue ReadingRetreat from 2017 Panic!

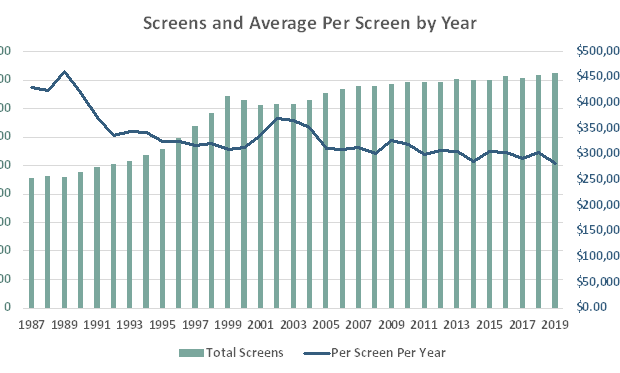

Box Office Returns to Form in 2018 In late 2017, the biggest story was whether box office was falling off of a cliff or not, after the somewhat disastrous Summer and weak Fall season we discussed in last year's Box Office Panic! series. We've Seen This Before We

Continue ReadingKey Risks in Making a Film, Part III

Steps to Green-lighting Yourself Until the day your film is funded, it is hopefully, fruitfully, in development. But what is development, and what is all this development for? Some think development is to get people attached: Actors and others whom you can "sell" to

Continue Reading