First, I’m Not A Seer

I do not style myself a future predictor, so, I want to say that I do not KNOW exactly what things will be like in 2021; but the following are not just random thoughts, they are based on detailed study.

Having spent a good bit of my life listening to, processing, and trying to understand the large and small signals of the film industry, I have learned a lot about how the gears of the industry mesh, grind, package and deliver entertainment, and how it is marketed and monetized. I use this information daily in my work, and it informs the financial models I create and the business plans I write. I try to mirror the real world, but, of course, we are reaching into the future with this work.

Too D**n Many Screens, Guys!

First, I want to say what I have been telling a lot of people for some time: The theatrical business has been over-built, with far more screen capacity than necessary, for more than 20 years (yes, 20 years!!), and the bill for all of this real estate and technology has been coming due for a long time. Now, a paroxysm of a pandemic has forced everyone’s hand; and the over-capacity of screens has caused exhibitors to hit harsh reality, and chains are being crushed under debt. This is not merely a function of Covid-19, but Covid-19 brought it to a catastrophic place.

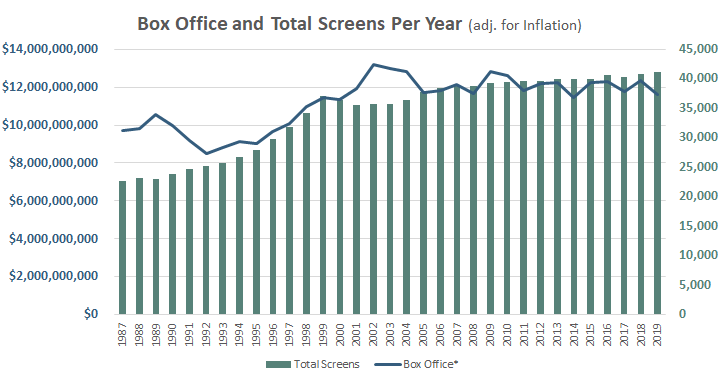

As we can see in the above chart, Inflation-adjusted box office showed the screens punched above their specific weight for half a decade, then began to track almost precisely with the number of screens, except for the abberation in 2004, based on The Passion of the Christ. Then began to track almost precisely to the number of screens again until things started to trend down in the 2010’s. .

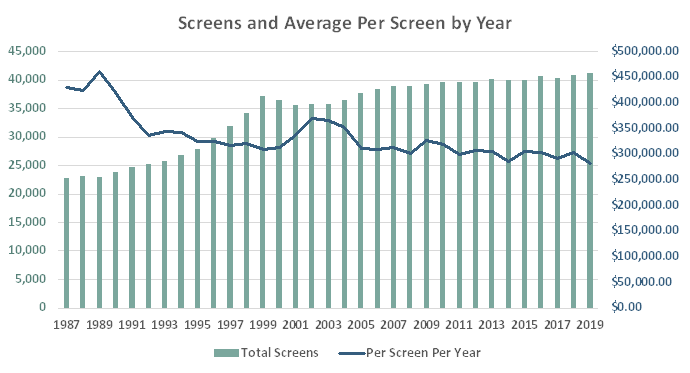

The following chart clearly illustrates that, starting in 1987, the annual take per screen was over $450,000, with about 23,000 screens available (including drive-ins), and ending in 2019, when there were about 43,000 screens (Cripes! Nearly double!) available (including drive-ins), with less than $300,000 per screen annual income. Unless each screen is being built at less than 65% of the cost of each screen in 1987, money is certainly being lost on the overall transaction.

Volume or Margin, Again!

I have talked often of the volume or margin equation. Movie theaters are items with too big a ticket on them, so why would you play them for volume? Anyway, that is what we have now, too many screens and (forget Covid-19 for a minute) not enough rise in sales to maintain a margin.

With less income per screen there is nowhere to go but further into debt. Now, with the collapse of sales due to Covid, it is causing chains to have to innovate and re-negotiate debt on facilities. Overbuilt with screens, no income, theater chains have had to become innovative, but even more importantly, start to rethink their previous extremely hard line on release windows. OMG, windows strategies are crumbling! Only months ago, one letter from an exhibitor chain explained their unmovable position:

“For 100 years, XXXXX (Exhibitor) has served as a strategically critical and highly profitable distribution platform for movie makers, and for all that time the exclusivity of the theatrical release has been fundamental.”

That sentence was kind of the introduction to the ultimatum that any abrogation of the relatively rigid theatrical window: “is categorically unacceptable.” But now, we have a lot of theater chains making deals with the studios that allow various mitigations of theatrical windows. Covid broke the theatrical window’s back.

Further, with a vaccine on the way, it is likely, as Anthony Fauci has said, that after the second quarter of 2021, theaters will be able to open much more normally, and audiences, hopefully, will begin to be confident to start going back to the movies.

But this post is not about over-building, is it? Not really, but to understand the pickle the big chains find themselves in due to Covid, and due to their exuberance, is to understand the potential opportunity for Indies who want to be out from under (at least I would think so) the thumb of the dumb entanglements of the theater chains and the studios. This is the background of the situation in which we find ourselves going into 2021.

The Perpetual Indie Conundrum — Always Following in The Wake of The Studios

Can I add another layer hinted at above? Indie films have been living with the devil-deals of the studios for years and years, from DVDs at commodity pricing, to restrictive release windows that can choke films off from reasonable market timing. Theatrical release is expensive, and indies have been hampered by these studio deals that cram the indies into a financial corner with few really good choices.

Shite, Sounds Like a Disaster!

Maybe, but indies, filmmakers and exhibitors, have been innovating the way mom and pop stores the world over have been doing forever, trying to keep their foothold on the dream of making and sharing interesting films with film fans, aficionados, and the adventuresome.

Before Covid indie theaters were already under stress, trying to update their projection equipment to digital at costs that were prohibitive for them, and even dealing with geographic blocks on distributors giving their films to local theaters because of a large chain’s prohibiting contracts.

During Covid, small indie theaters have set up their own digital channels, put mini drive-ins in small-town parking lots, while smart indie distributors like IFC, RLJE and others have booked drive-ins during social distancing, and become almost the only players on the box office charts this year. And IFC did Day and Date VOD and Drive-in releases. Innovation in thinking, and innovation in action are our path forward!

What Do I Think We Might See in 2021?

Because of the stress on the chains, I see the windows erosion unstoppable. Large chains, instead of throttling the windpipes of distributors, will be much more amenable (while grumbling) to windows that are not so restrictive, and I, for one, would be pushing very hard to enable and pursue hybrid release patterns that blend Box Office and Digital in recipes that are different for each film or film type. And that includes many more players pursuing Day and Date releases that enable a consumer to see a film where they want to see it. Of course, the Digital Subscription model is going to not only emerge as king, as it is now, but it will solidify its lead with many film types. That does not mean that SVOD is the be-all and end-all platform for indies. The theatrical release that puts so much pressure on the opening of a film does not understand that many indie films have long shelf-lives, not at all like the slam it at the theaters and scoop up early dollars while the value of the film decays right before your eyes.

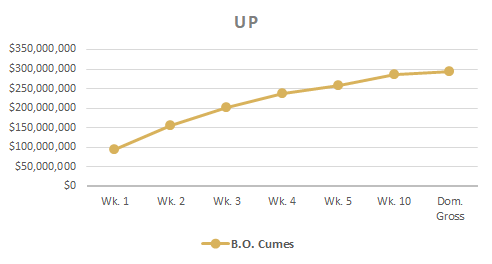

This is what that kind of wide release decay chart looks like:

You’ll notice in the Up box office chart above that by Week 5, something like 83% of box office take has come in, and by Week 10, the box office cumulative is in the upper 90% range. The film, which earned a lot, has burned out at theaters. This slam it at the wall strategy has made all of these releases immediate do or die scenarios.

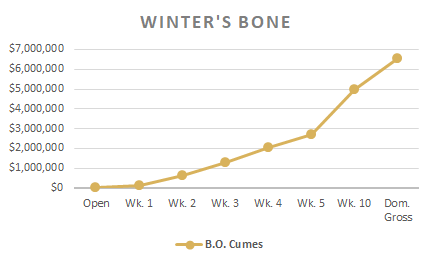

Let’s look at an indie like Winter’s Bone, and see what it’s 10 week box office trend looks like:

We can see that Winter’s Bone was at only 41% of its total box office in Week 5, and at only 77% in Week 10. Winter’s Bone held on in theaters for 45 weeks (BTW, close to a year!), giving audiences a chance to learn about it and catch up with it, while not burning through all of the world’s cash in marketing. While Up was in theaters in some form for 23 weeks, it was really burned out by Week 10. Certain kinds of fast and hot releases are right for certain kinds of films, but most indie films require more detailed and attentive handling, like Winter’s Bone. I want indies to have the maximum leeway in their choices, Day and Date if necessary and wise, and long slow roll outs if that is necessary and wise, and I believe the soft market will be much more viable for this kind of hybridization, as I call it.

My Models Now

Almost all of the financial models that I have crafted for smaller indie films since about May or so of this year, plan on some kind of hybridization of Theatrical and Digital, and plan on a very attentive release pattern. This is the way of the future. There will no longer be, I believe, a “one-size-fits-all” pattern for releasing indie films, and each needs to be planned for, modeled to the real world, and should take significant advantage of the soft spots that we will see in the markets for some time to come.

Onward and Upward

Jeffrey Hardy

To get more content like this, sign up here:

–If you would like to learn more about our services for Indies, or discuss in detail how we might help you, especially in this new complex climate, please fill out our project submission form as fully as you can.

Very interesting article. I always ask people “how much money should you borrow?”. Most people do not know the answer. The answer is simple. You borrow as much as you can invest and make a profit. For example, I would borrow a billion dollars at 4% if I could invest it at 5%. Once the curves invert and my marginal borrowing is at 6%, I would stop borrowing. Same for theaters. I would build as many screens as I could make a profit. Obviously, chains are going to need to put films in their theaters. I foresee more independent films filling empty screens so long as the theaters can cover their operating costs. Then they can only hope for the best and that a few catch fire like Winter’s bone.

Good addition to the discussion, Greg

What an educational article Jeff! It’s hard to find information out there that is accurate as social media skews everything. Thank you for being a great resource for reliable data.

Thanks a lot!

Love that you’re including a hybrid with theatrical and digital. I’m curious how we can model for a digital release (I mean actually all digital with no theatrical release) for indie films when we don’t know what Netflix and Amazon and the HULUs of the world are paying the producers for their films?

For certain size films, I am doing either a hybrid, a digital strategy as one or two of the scenarios of a model, or all three scenarios as digital only. There are strategy elements to each level in those.