In this era of ‘Big Data’ buzzwords flying everywhere, “We at FilmProfit prefer to focus on the accuracy and the appropriateness of data, not its height or its girth.”

FilmProfit Uses Latest Data Science Techniques to Guide Financial Modeling

Deep knowledge of the film business, an Institutional Memory of its patterns and its deal structures is crucial to understanding and managing risk. Markets in evolution fall back on tried and trusted deal structures, even when deployed in new patterns. We track these patterns. Big pools of data cannot give you this. At FilmProfit, we bring this institutional memory, and our powerful data knowledge, coupled with the latest data science techniques to rational decision-making in film business planning.

Good Assumptions Start Good Data Science Studies

In data science, one must always start with assumptions, so knowing what to assume moves one instantly ahead when seeking Confidence and/or Probability. And, not knowing what to assume or what is actually customary, then any data could be seen as telling you its secrets, when it is actually not giving up any significant secrets at all. In a complex system, we never have complete information, so to analyze a system, we have to know the system well, and then look for important links in the observational data, before making a case for a potentially valid inference. Does knowing the differences in market deals at different levels require us to think differently for different types of films? Does knowing the differences in how women and men approach movie-going at different ages, and for different film types mean anything? Does knowing the base and evolving structure of Chinese, or Japanese film distribution help us with modeling for these markets. We definitely believe it does, and we believe it can impact your business, and we believe that it works with and provides a separate set of signals that pure pools of box office data cannot. We use these signals and many more, combined with our command of practice, to help us choose and organize our data and assumptions, and to help us have a valid starting reference.

Science realizes that in evidence-based work we are often focused, like in a courtroom, on the causal elements of what is at hand. But, we must admit that all systems contain randomness, and that there are causes which exist that are very difficult to discern. Now, the human brain is a very powerful computer, but even the human brain cannot ascertain all of the random and non-random elements in a circumstance or a pool of data, and certainly not with alacrity. So, we use the latest techniques in statistical analysis to help us feather the non-random elements in our data to the surface, where they can be analyzed, while sequestering the random elements at the edges of the system and beyond.

Data Science Aids Us in Complex Systems

A complex system such as producing and releasing a film, contains randomness and uncertainty because there are so many independent operating parties along its path. In data science modeling, they call these operating parties “agents.” The individual goal-seeking of those agents can create randomness, uncertainty and complexity.

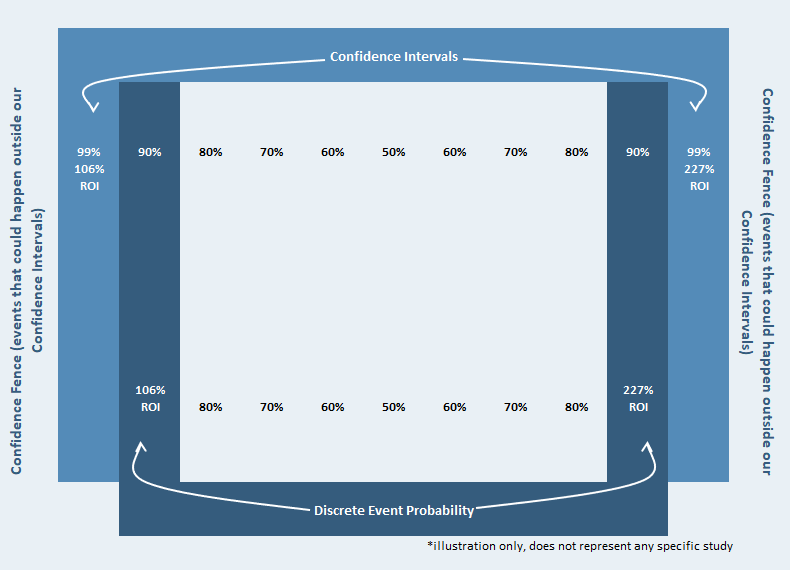

We start our work with the understanding that there is and will be randomness and uncertainty, so we are able to focus our attention on the string of non-random events, those which maintain relative stability. These we analyze to ascertain with a high level of CONFIDENCE (90% or above), so we can see a path forward. We can also push this confidence further, labeled in data science as PROBABILITY, using our proprietary tools. Within these bounds are the things of which we feel pretty confident, or which we can describe as probable. These things, then, enable us to identify the range of events where the randomness and risk are not so high, and even the areas where the randomness exists, thereby enabling us to focus on our confidence range, or on our probability range.

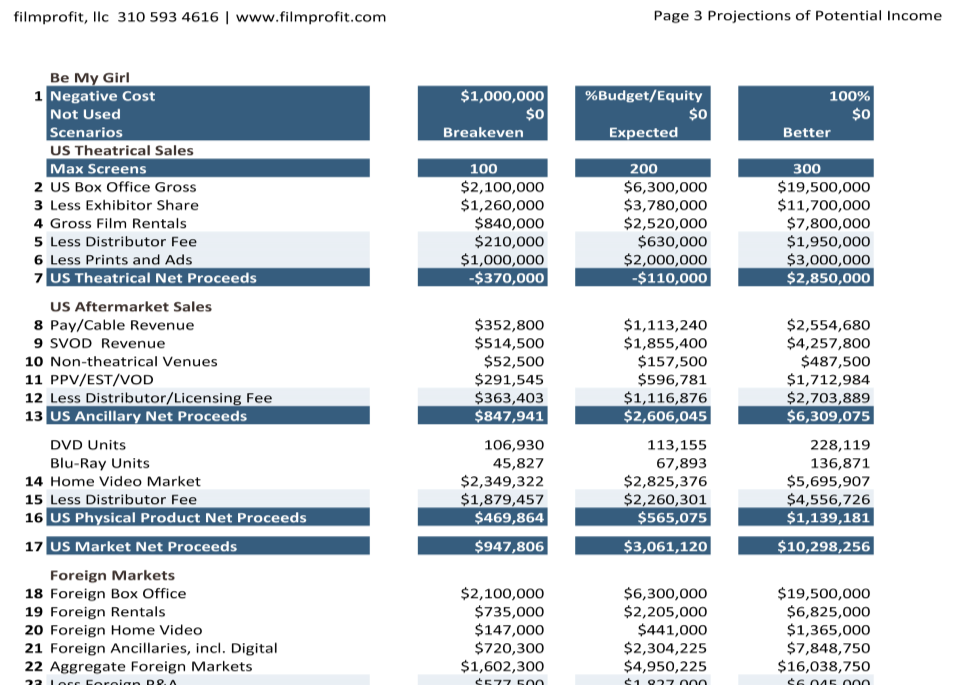

FilmProfit has long produced proprietary models for estimating the financial performance of films in distribution, from the very low budget, like Sweet Land, to the very high budget, like this summer’s The Meg. These models have been used by producers for hundreds of films. In a standard three-column format, Low, Expected and Better, they are still a very viable alternative for modeling a film.

An Illustration of our three-column conventional projections model

Understanding the range of risk or performance, is an exceeding powerful business planning tool, and a powerful driver in targeted negotiations that impact your film’s performance for your team. Over the last year, building on our deep institutional memory of the film business and utilizing the newest aspects of data science, we have put significant time and effort into developing a system for effective and affordable Risk Analysis using our proprietary data to arrive at two new reports which provide significant advantages for our clients:

Report 1. Filmmaker’s Statistics-Driven Financials

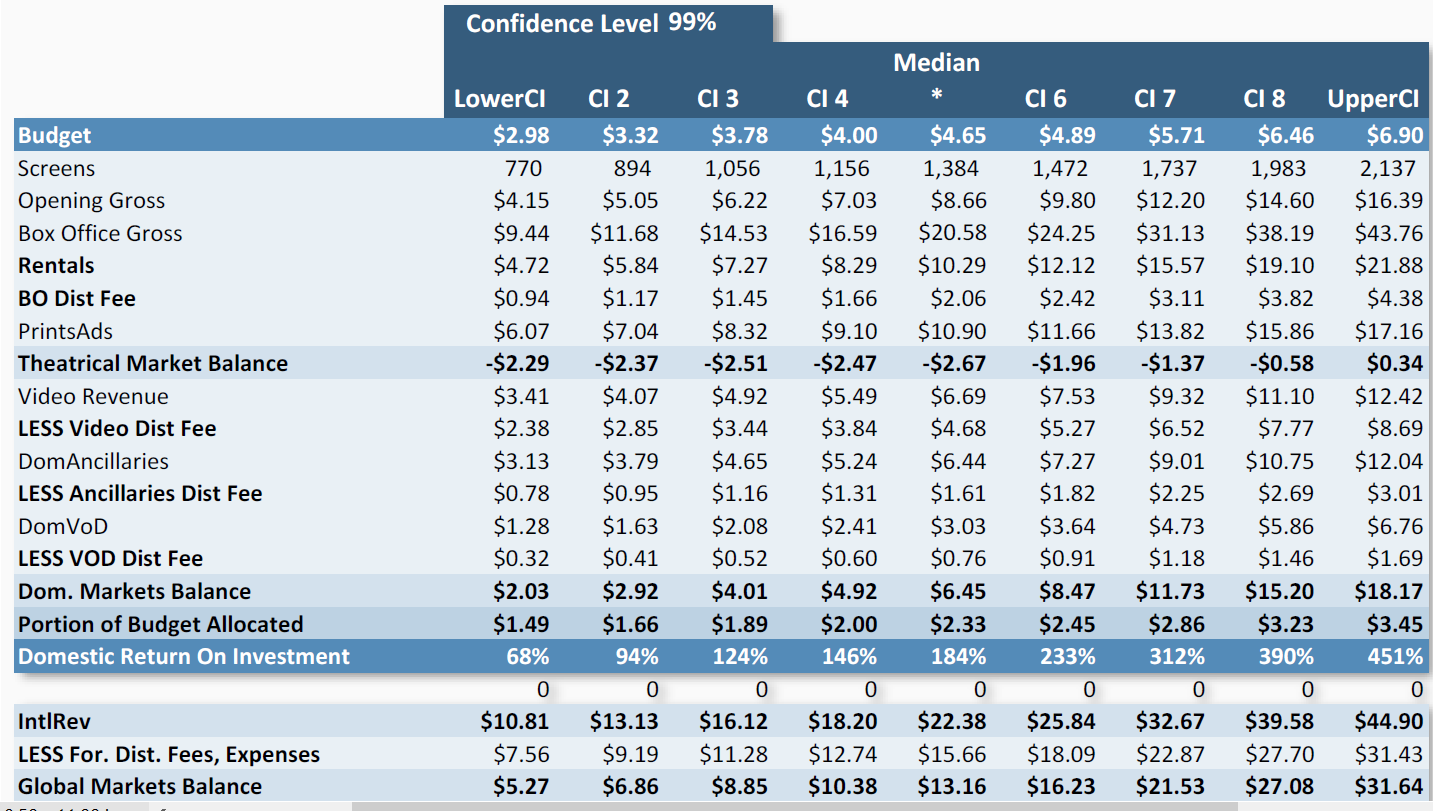

With designated 90%, 95% or 99% Confidence Level and detailed performance ranges in the assessed output, based on individually separate market signals bootstrapped a minimum of 3,000 iterations on each signal. This robust report is targeted to single films, or slates of up to three.

Report 2. Producer’s Continuous Event-Driven Financials

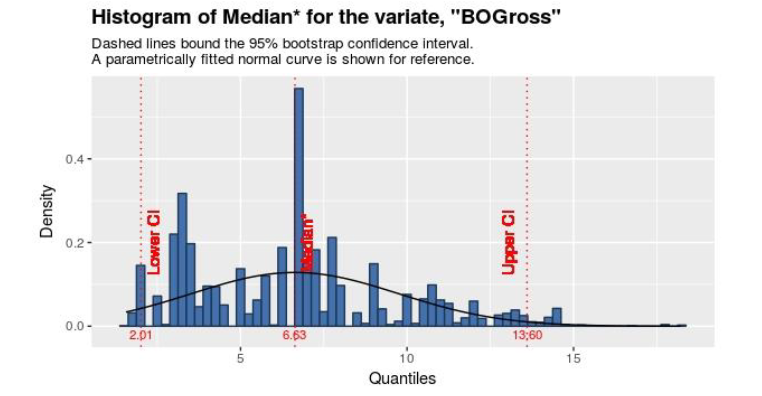

A Continuous Event is an ordered (or “chained”) sequence of sub-events, such as box office and budget and opening and maximum screens and foreign box office all tied together to find central tendencies of these when chained in a bootstrapped analysis of a minimum of 3,000 iterations on each signal. We use this much more complex analysis to achieve an even greater modeling environment. This report is ultra-powerful with both single films and slates of films.

Six Reasons Why This Analysis Is Meaningful

- It enables a client to gain prudent evidence-based scientific inference

- This data analysis effectively describes the range of performance within our Confidence Levels or Probability Range with designated levels of confidence and/or probability, further defining the client’s “less-risk” path pointed out in the analysis.

- It is backed by a deep institutional memory of the industry practices and structures

- It uses rigor and discipline to achieve a practiced analytical approach that can take the results of the data analysis and apply it to any client scenario parameters, any deal point structures and any waterfalls, even including specific target parameters for an individual offshore target market, such as China, or the UK, and so on.

- It supports planning for effective long-term outcome over risk.

- It is an affordable approach to giving a client greater confidence in business planning for a film.

An illustration that shows elements of the kind of detail in the nine scenario results

This level of inquiry and enables us to plan in much more detail, and to understand the field with a higher confidence or a higher probability.

FilmProfit’s new analysis tools:

- Increase your speed to market

- Result in triple the number of model scenarios

- Give us clearly defined boundaries at the Upper and Lower Confidence Intervals

- Give us even more sharply defined fences in the Probability Range, providing us a finer-tuned approach to our discerned outcome ranges.

A conventional histogram illustration that enables us to understand the detail in our analysis

The power of this new approach can be acquired for your film project or slate, by contacting us at https://filmprofit.com/contact/

FilmProfit is the premier business planning consultancy for filmmakers, financiers and studios, with clients in all the filmmaking centers around the world, from Los Angeles to New York, to London to China and India, and covering all the areas in between. FilmProfit has been striving for 25 years to aid independent film producers to develop and operate with good business practices, by providing them with the business planning tools that meet this mission, including, FilmProfit ROI Comparable Pictures Reports, Projections of Potential Income, and End to End consulting in the preparation of a film to deliver successfully all the way to market, including target audience analysis and much more.

FilmProfit® is a registered trademark of FilmProfit, LLC.

If you are new to us, you can get our Newsletters by signing up here: https://tinyletter.com/FilmProfit (powered by TinyLetter)

Subscribe and get these missives sent to you.

LIMITED TIME ONLY! In honor of the last Sundance in Park City, we are offering a 25% discount on Filmmaker's Financials Package and Producer's Financials Package. Use the discount code SUNDANCE2026 in your cart. This discount runs through February 14, 2026.

Quick questions, send them here.

To submit a project and get much more detailed information about our services, submit it here.

Leave a Reply