Utilizing Evidence-based Statistical Analysis

Over our 25 years of financial modeling for films and slates and funds, FilmProfit has developed sophisticated methods for modeling and managing the financial risk associated with films in production or distribution.

Because of our hard-won proprietary data and years of deep diving into the arcana of markets, we have leveraged our baleen whale tendencies toward information collection and processing toward enabling statistical analysis beyond projections.

We have crafted financial models for hundreds of films, from the quietly beautiful Sweet Land, to the challenging comedy of Sleeping Dogs Lie, to the Gen Z Mexico road trip movie Baja, and films like Lost City of Z, all the way up to the blockbuster sized The Meg. All these films were modeled using our deep experience and institutional memory of the industry. We are continually working to enhance the quality of our work, and now we have again pushed it forward, by developing algorithms which take key data through thousands of bootstrapped iterations that can be used to derive two levels of analysis.

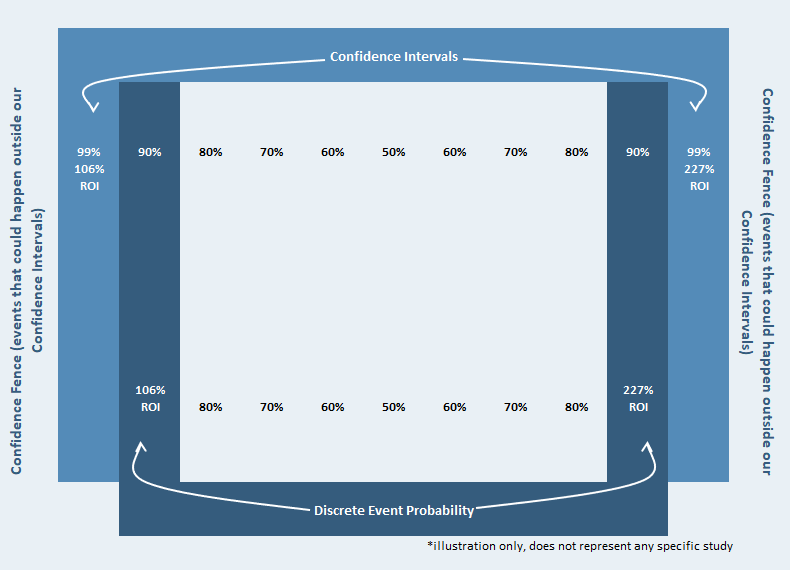

We here at FilmProfit have devoted considerable time and effort into formulating a statistically meaningful approach to estimating Confidence and Probability (two different things in statistics) in our model for a single film (Illustrated below at different potential budget targets) and for film slates.

Confidence Intervals Illustrated

Actual Results Plotted for a Film’s Return Potentials

Plotted Intervals Chart

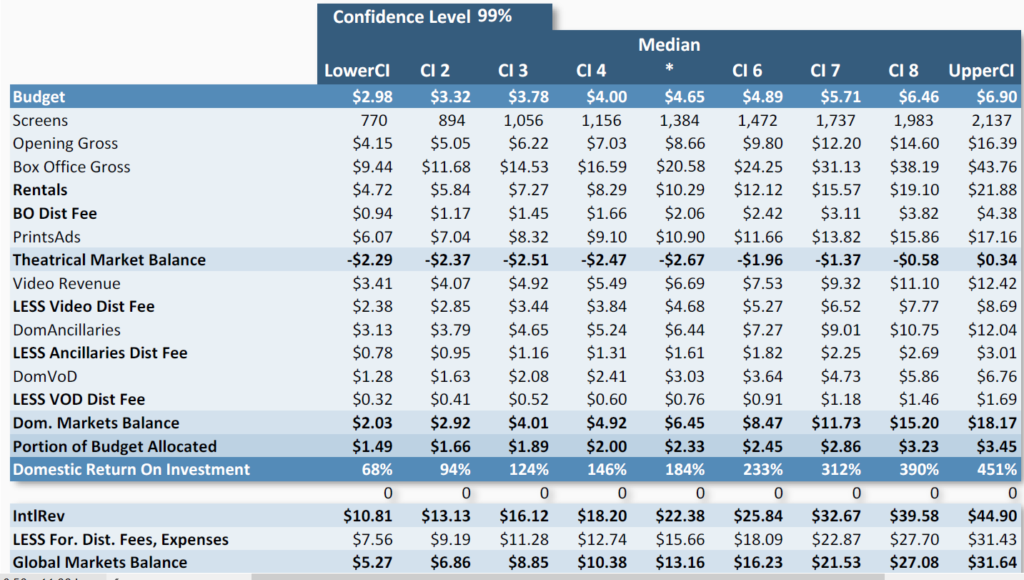

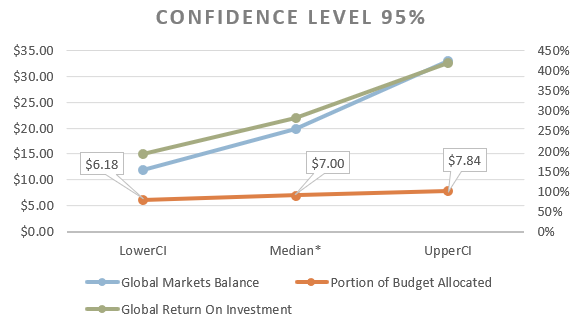

Illustrated is the projections model from a discrete scenario study where we not only wanted to know the pool’s targeted performance, but the various budget ranges and their characteristics bounded by Level of Confidence. The beauty of this discrete scenario approach is that it takes us well beyond our typical projections modeling in three scenarios, while also increasing the confidence of the models. The statistical validity of our approach has been verified and used in real-world situations, for both single films and slates, for finished films and business planning for future films.

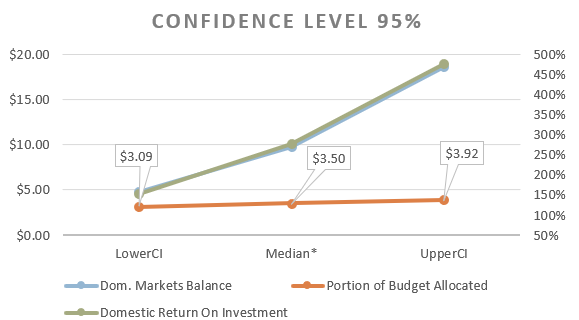

Also shown is an illustration of a method we have developed for showing the Confidence Levels when studying the potential performance of your film across a range of markets. Our models take bootstrapped data sets and estimate these confidence levels based on target fee and costs structures.

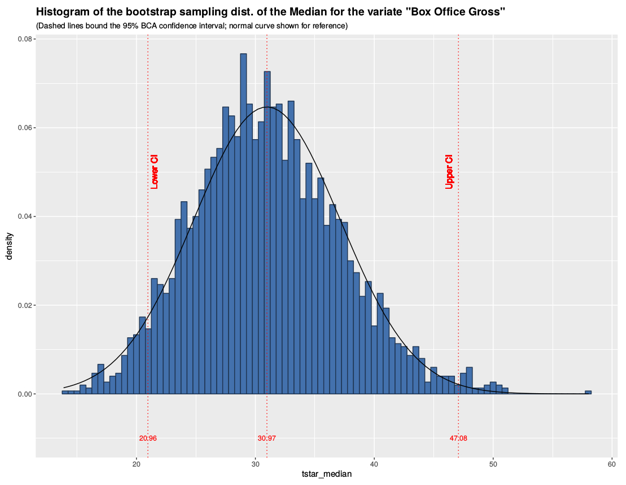

We can divine market performances for a range of budgets determined by the data, to target maximum potential ROI and effective budget, or targeting a single budget, based on bootstrapping thousands of iterations from our dataset. Based on Bootstrapping Comparable Pictures ROI data to a minimum of 3,000 iterations on each key parameter.

Results can be delivered in only one of the following Confidence Levels for each report:

- 99%

- 95%

- 90%

Then we plot the nine Confidence Intervals from Low performance to High performance in each key parameter. This gives us a highly robust, statistically meaningful insight into the relationship of markets, and the potential performance of your proposed picture, based on analysis of historical performance and in light of market trendlines.

The Report Consists of A Nine-Scenario Model

- Attendant Illustrations

- Detailed Written Analysis

- Two Hours of Consulting

This Analysis Can Be Executed On Your:

- Single Film (Supplants Filmmaker’s Financials Report)

- Slate of Films

- Fund Strategy

If you think the business plan for your film or slate could benefit from this kind of robust analysis, or if you have questions, please fill out our Project Intake Form

Statistical Analysis (a little bit of explanation)

The bootstrap method is a re-sampling technique used to estimate statistics on a population by sampling a data set with replacement.

It can be used to estimate summary statistics such as the mean or standard deviation.

Discrete event simulation (DES) is a method of simulating the behaviour and performance of a real-life process, facility or system.